PayPal - Payments built on trust

With a user share of 91%, PayPal is the most used payment service in the UK1

Offer PayPal, the name millions trust.

PayPal's brand recognition helps give customers the confidence to buy.

71% higher checkout conversion 2

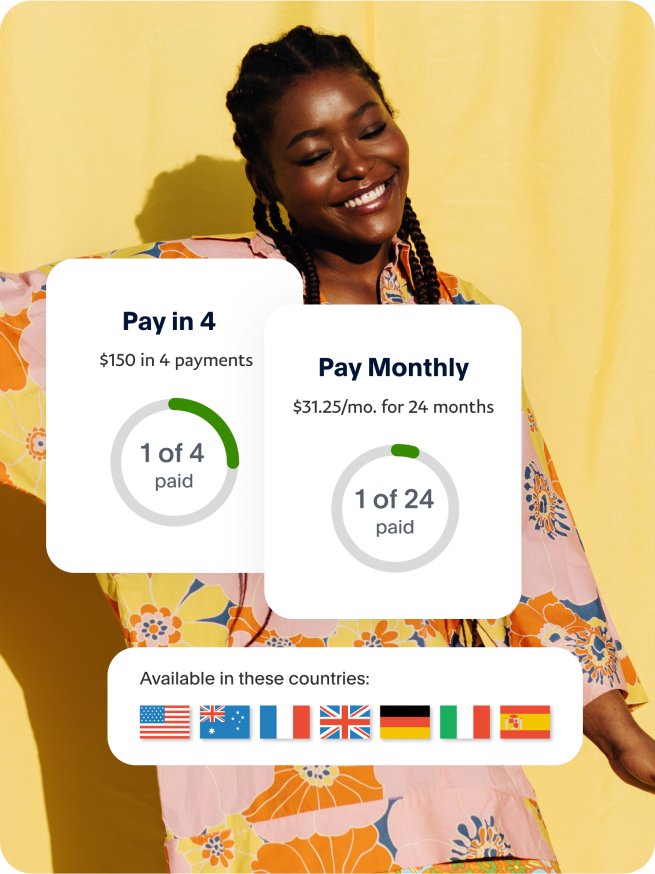

Go ahead, let them Pay Later.

Let customers pay in instalments with Pay in 33 (Pay in 4 in the US) – while you get paid up front and in full at no extra cost to you. Promoting Pay in 3 on your site at key points of the shopping journey encourages customers to buy more4 — and more often 5.

216% Pay in 3 has an AOV that is 216% higher than a standard PayPal transaction 6.

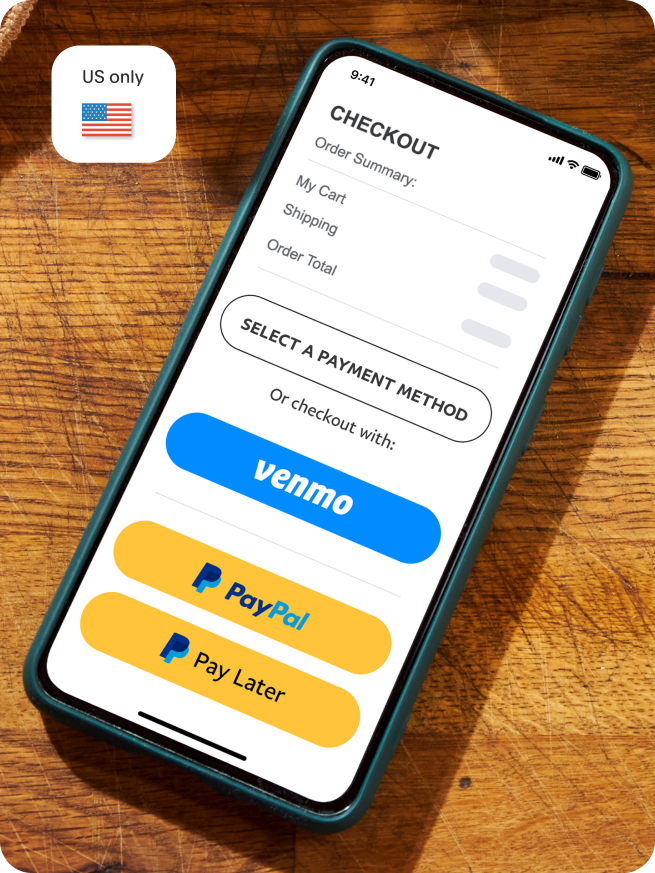

Get NextGen shopper appeal with Venmo.

Venmo (US only) is the go-to payment option for Millennial and Gen Z shoppers in the US. It’s part of PayPal Checkout — at no additional cost. Gain appeal to Venmo customers who are active spenders8 with more spending power.9

Go global. Make it local.

With country-specific payment methods, like Ideal, Sofort and Giropay, you can reach international customers while making your business feel local. Build trust and include options like Payment Upon Invoice (PUI) — a local payment option available only for purchases completed in Germany.

Take charge.

Add all major debit and credit cards to your all-in-one solution. It’s easy to manage and we handle the processing.

Designed with your business in mind.

Accept payments in-person payments.

Sell in-store with Zettle by PayPal. Accept all the popular card and contactless payment types quickly and securely and bring your online and in-store worlds together.

Learn more

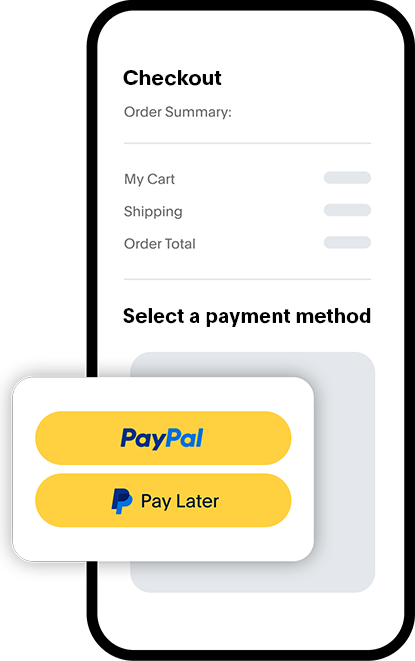

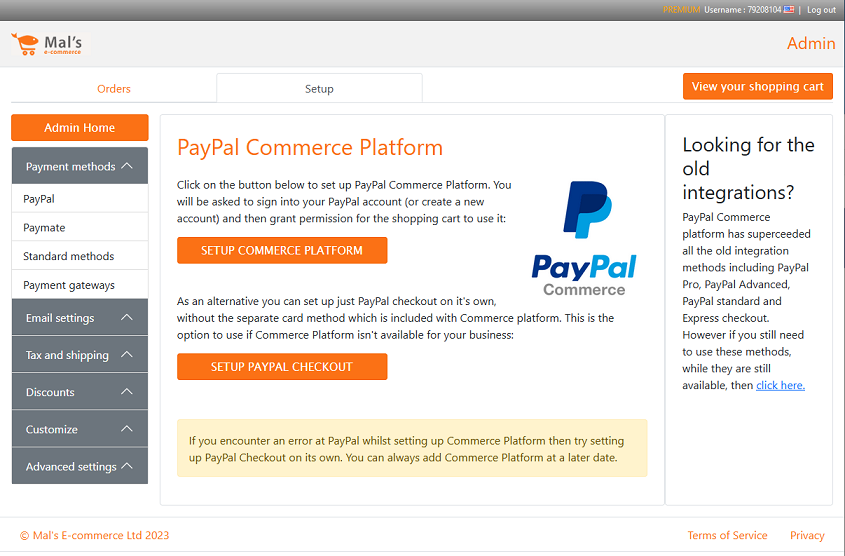

Simple setup.

See how to activate.

Step 1

Login to your shopping cart account (Admin).

Step 2

Go to “Setup” in the top navigation bar and click on "PayPal Commerce Platform".

Step 3

Select the “Setup Commerce Platform” button.

Step 4

Once approved and enabled, you can start accepting payments with PayPal.

1 Statista, Global Consumer Survey Brand Report, Online payment: PayPal in the UK, May 2022. Base: n=1,605, online payment users

2 Nielsen, Commissioned by PayPal, Nielsen Media Behavioural Panel of UK with 14,072 SMB desktop purchase transactions from July 2020 to June 2021. *Checkout conversion - from the point at which customers starts to pay.

3 Pay in 3 availability is subject to merchant status and integration. Consumer eligibility is subject to status and approval. Pay in 3 is a form of credit, may not be suitable for everyone and use may affect consumer's credit scores. See product terms for more details.

4 TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1,000 UK consumers ages 18+. Base: BNPL Users n=303

5 TRC, Commissioned by PayPal, April 2021. TRC conducted 20 minutes online survey amongst 1,000 UK consumers ages 18+. Base: BNPL Users n=303

6 Based on PayPal internal data from Q1 2022, results include Pay in 3 (UK)

7 See PayPal developer documentation (https://developer.paypal.com/docs/checkout/pay-later/gb/) for the latest availability of Pay Later features and benefits in your region(s)

8 Focus Vision, Commissioned by PayPal. October 2020. The Venmo Behavior Study explores valuable insights for merchants to consider to reach a broader audience including 2,217 Venmo customers' financial habits, purchasing behaviors and perceptions of Venmo as a payments tool.

9 50% of Venmo users are more likely to have a high household income than online payment users overall. Source: Statista Global Consumer Survey as on July 2020. The target population are internet users in U.S. between 18 and 64 years of age.

10 Edison Trends, commissioned by PayPal April 2020 to March 2021. Edison trends conducted a behavioural panel of email receipts from 306,939, US consumers and 3.4+ M purchases at a vertical level between Pay with Venmo and Non-Venmo users during 12-month period.

11 Nielsen, Commissioned by PayPal, Nielsen Media Behavioural Panel of SMB desktop transactions from 3,778 UK PayPal users from July 2020 to June 2021. Q4, 2021, UK

12 Nielsen, Commissioned by PayPal, Nielsen Media Behavioural Panel of SMB desktop transactions from 3,778 UK consumers from July 2020 to June 2021.

13 Availability may vary depending on merchant’s integration method and geographic location.

14 Available for eligible transactions. Limits apply

15 Available on eligible purchases.